Business profitability and why is it more than an income greater than expenses.

Why do you own a business? To be part of something bigger than yourself? To build something exciting? Call me an old-timer, but I secretly believe the purpose of every business—okay, most businesses—is to create profit.

What’s profitability, though? Is it how much you have in the bank at the end of each month? Too much money in the bank could also mean you are not investing in business growth. You could buy that PSA software that helps your technicians manage client interactions better. You could finally invest in a foosball table for your office. Then probably hire an R&D manager for growth planning (priorities!).

So, how do you define if your business is profitable?

Hint: Burden rate.

The proof is in the profitability

The burden rate refers to the cost incurred by the employees in an organization. It includes any associated liabilities including employment perks, paid leave, and overhead expenses.

In a nutshell, the burden rate is how much your engineers aka billable resources actually cost the business.

The fully burdened cost of the engineers, not just the hourly rate, is a clear-cut measure of the cost of delivering a project. These costs are not always apparent. There could be hidden costs, which when left unnoticed, could end up flying under the radar for years.

“As a business owner, one of the most important things you need to know is how profitable your business is. This impacts whether you stay in business or not.”

- Chris Timm

You need to know how much your engineers are costing you when you work for a client. The burden rate is the cost of the engineer, so if you do 1 hour of work at $100 and the engineer costs you $20, your profit is $80. That’s the truest reflection of how much the project is worth, minus the miscellaneous costs involved in project delivery. And there are several ways to calculate burden rates.

Calculating burden rates: The good, the bad, and the ugly

The GOOD

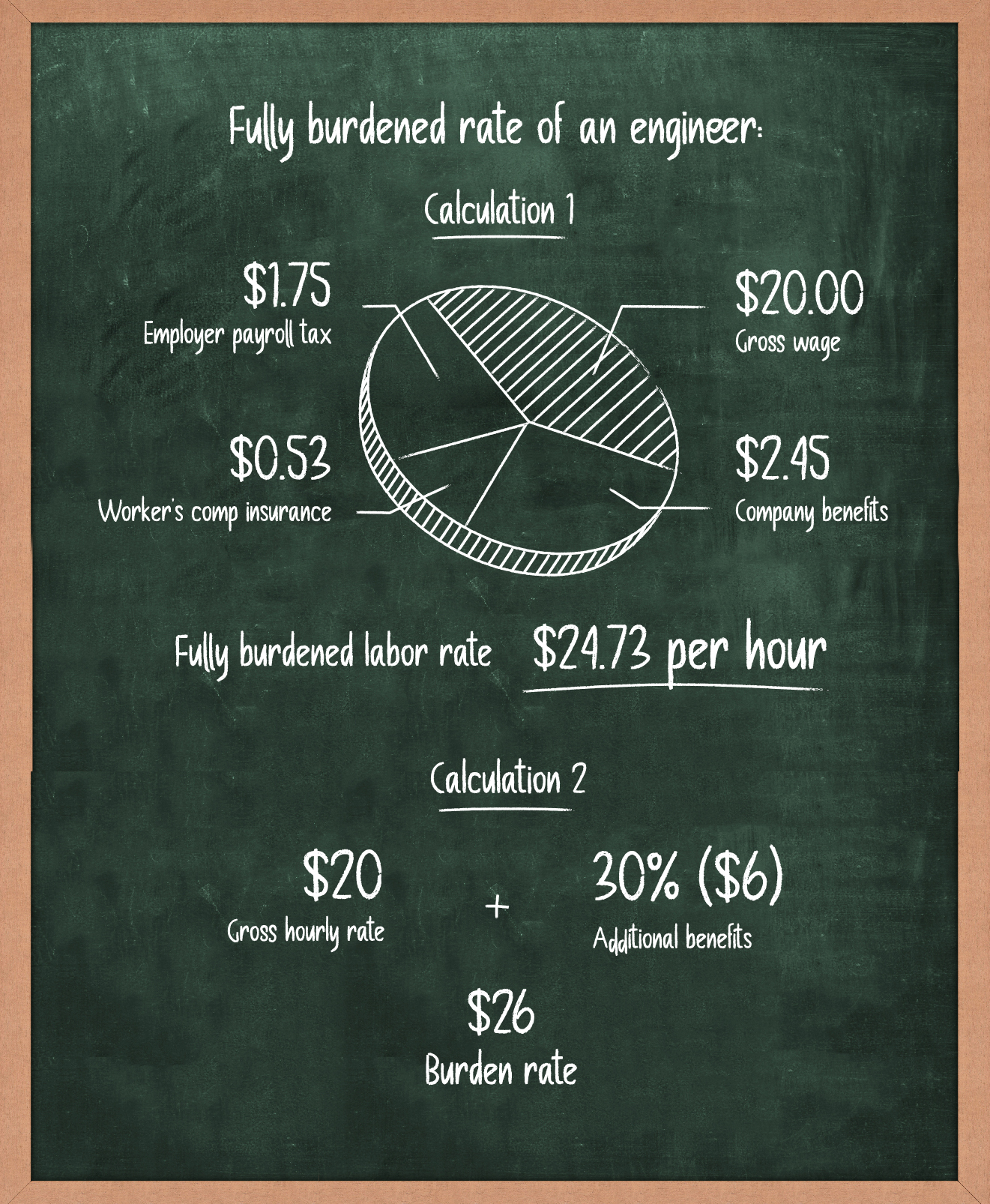

The “Good” way calculates the direct and the associated labor costs. This is the best way to measure the burden on business.

The other good way is to calculate the total burden rate by adding benefits as a percentage of the gross wage per hour. Here are a couple of examples showing how.

The BAD

The “Bad” way of calculating burden costs is measuring everything to the Nth degree - the desks, the sticky notes, the coffee cups, and the number of stars in the sky!

Lowering burden expenses can boost your balance sheet, no doubt. Small businesses are usually encouraged to tighten their purse strings as their scope to experiment relies on how dependent they are on external sources for money. But, it won’t help here, when you’re calculating “people cost”. Spending on people is not reckless, up until a certain point. They make your business. Or break.

The UGLY

The "Ugly" way does not consider the additional costs associated with an employee.

This can sweep a lot of crucial details under the rug. Here the burden rate is simply based on working out the hourly rate by dividing by the number of weeks in a year and the number of working hours in a week to get the employee’s hourly rate.

But profits are unpredictable. The tides are always changing. There are too many costs to account for, too many moving parts, and next to zero visibility into what’s happening.

Unburden your business with a PSA

Starting a business costs you money. Driving profitability costs more. Getting the basics right makes all the difference. And once you do, it is just a matter of scaling the success. While it may seem like profitability is simply having more income than liabilities, it’s not that simple. Put a premium on the burden rate to make informed decisions, securing your financial predictability and posture. And put a premium on a PSA tool...

A PSA tool brings finance, accounting, projects, and people together under one ecosystem, giving a snapshot of your organization’s financial state at any given point.

The ability to track projects in real-time, expenses involved, and the corresponding ROI makes PSA the ultimate go-to for MSP business owners to take stock of their finances and drive improvement efforts. If you’re on the fence about getting a PSA, this is your sign.